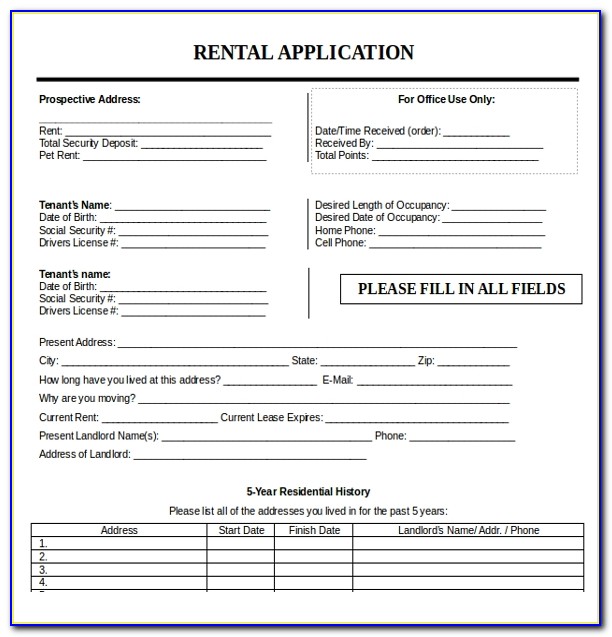

You can also buy coverage online or in person. Unlike other forms of insurance, there are no waiting periods for purchasing renters insurance. If your lease requires you to get renters insurance, it doesn't take very long to get coverage. How long does it take to get renters insurance?

Before you purchase your own policy, make sure this isn't the case for you - otherwise you'll pay twice for the same coverage.īut keep in mind: If your lease doesn't make renters insurance mandatory, your landlord can't legally hold you responsible if you choose to remain uninsured. In some states, like Virginia, landlords can purchase renters insurance on behalf of their tenants and include the price of a policy in the rent. Some states, like Oregon, limit how much your landlord can require you to buy. Oklahoma is the only state that prohibits landlords from requiring tenants to buy coverage. How much renters insurance do landlords require?

If you suffer a loss and your landlord discovers you never fulfilled your lease requirements, you may face eviction. With some landlords, a verbal confirmation from you might be enough proof that you've purchased renters insurance. In these cases, you may be able to supply proof of your renters insurance by uploading a digital copy of your declarations page directly into the program. Some property owners - usually large companies with multiple tenants - use property management software to communicate with their renters. An insurance representative might send a copy of your declarations page to your landlord digitally or through the mail. After you purchase renters insurance, you can ask your insurance company to send proof to your landlord.

Provide your policy's declarations page.

0 kommentar(er)

0 kommentar(er)